![DSC_9043[1] DSC_9043[1]](https://opportunitybank.co.ug/wp-content/uploads/elementor/thumbs/DSC_90431-scaled-qyznhzbh7a6emifww3qq2z3tl8xckdyr06h0xl724o.jpg)

A CHRISTMAS MIRACLE: OPPORTUNITY BANK AND FURAHA SPREAD JOY AT ST.LILIAN HOME

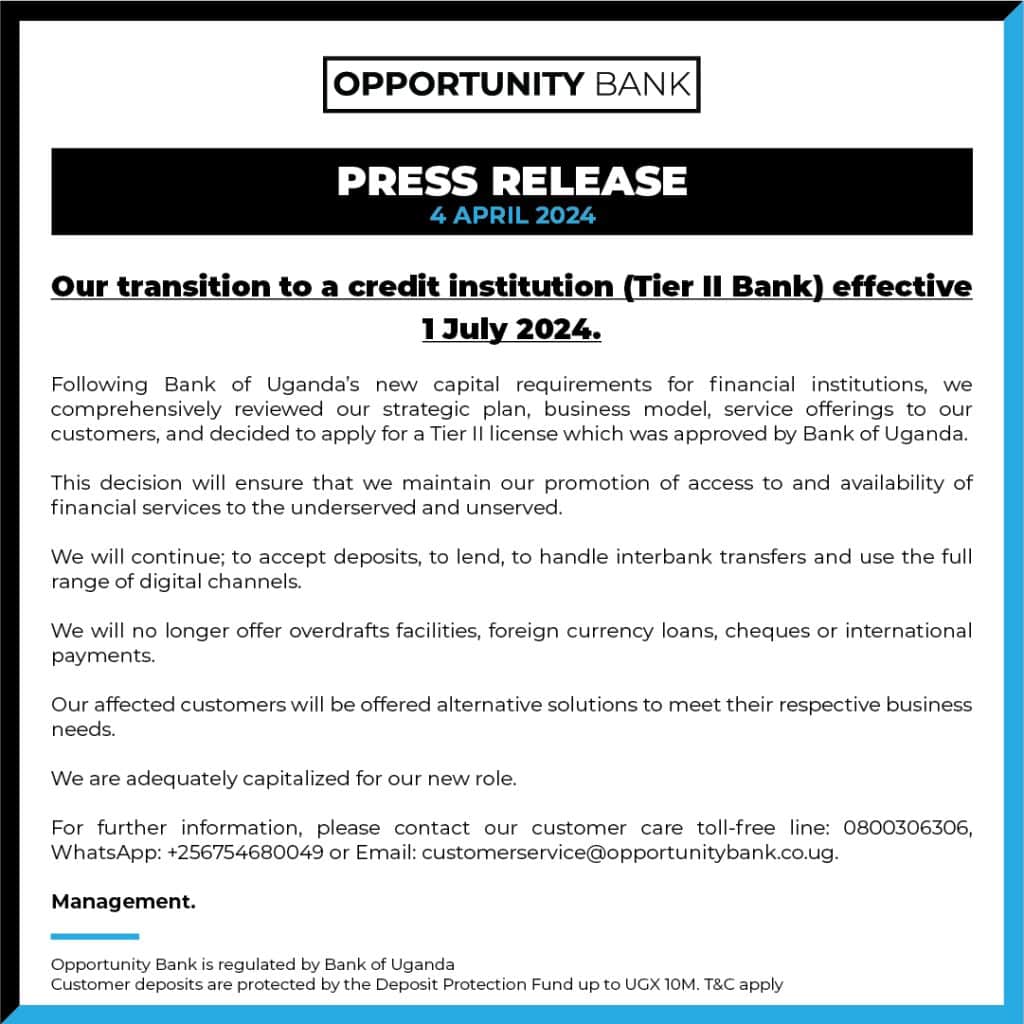

This Christmas, something magical happened in Busika. Opportunity Bank, hand-in-hand with our cherished partner Furaha, embarked on a heartwarming journey to bring smiles to the faces of the children at St. Lilian Home. What unfolded was nothing short of a Christmas miracle, filled with love, compassion, and the true spirit of giving.

Aligned with Opportunity Bank’s mission to transform and uplift the lives of ordinary individuals, this holiday season marks a special moment for the bank to share cheer with several communities. With deep-rooted values of commitment, humility, respect, innovation, service, and trust, Opportunity Bank remains dedicated to making a lasting, positive impact on the lives of individuals and communities. This initiative reflects Opportunity Bank’s unwavering commitment to supporting the well-being of underserved communities, reaffirming the bank’s dedication to social responsibility and its core mission of service.

The holiday season is a time for compassion, love, and giving, and this year, Opportunity Bank and Furaha have ensured that the children at St. Lilian Home (children with special needs and the homeless) feel the warmth of these values. Through the donation of much-needed food supplies and the organization of a festive celebration, the partnership has not only filled hungry tummies but also brought wide smiles to the faces of these vulnerable children, offering them a glimpse of joy and happiness during this special time of year

Imagine children’s excitement and beaming smiles as they received food supplies, including rice, posho, sugar, beans, bread, and a bounty of hope and joy. The air was filled with laughter and the warmth of human kindness as these essential items found their way into eager little hands. But the giving didn’t stop there – toiletries, clean water, and even sweet treats were shared, ensuring every child felt the embrace of care and comfort.

Owen Amanya, CEO of Opportunity Bank, shared his thoughts: “It is a privilege to share love and joy with the children at St. Lillian home this Christmas. In this season of giving, we reflect on the love and sacrifice of our savoir Jesus Christ that inspires us to share with our sisters and brothers. This comes to show our love to the children and bring them hope during this festive season”

The holiday season can be particularly challenging for children who have faced hardships. Still, today, thanks to the combined efforts of Opportunity Bank and Furaha, St. Lilian Home was transformed into a haven of joy and celebration. Mr. Dennis Musinguzi, CEO of Furaha Financial Uganda, reflected on the experience: “To see the children’s faces light up… it’s a reminder of why we do what we do. We’re not just meeting immediate needs but planting seeds of hope that will blossom for years to come.”

This partnership between Opportunity Bank and Furaha has shown us all that even the smallest acts of kindness can create joy that touches countless lives. It’s a beautiful reminder that we can create moments of pure magic when we come together with open hearts.

As we celebrate this season of giving, Opportunity Bank and Furaha extend a warm invitation to all: Join us in this journey of spreading kindness. Together, we can weave a tapestry of love and support that wraps around our entire community, making this world a little brighter, one smile at a time.

Let’s carry the spirit of this Christmas miracle in our hearts throughout the year, remembering that each of us has the power to make a difference in someone’s life.