OPPORTUNITY BANK- PWDS

Who We Serve

Opportunity Bank Uganda Limited (OBUL) designs products and services to serve financially excluded and underserved individuals, their children, and communities across Uganda. Currently, OBUL serves 27,576 borrowers and 379,326 savers, helping families build sustainable livelihoods and access quality education for their children. We work with entrepreneurs growing small businesses, small-scale farmers, and families building brighter futures for their children.

Particularly, Opportunity Bank aims to reach:

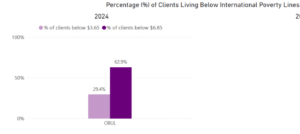

Those Living in Poverty:

In Uganda, 41% of the population lives on less than $1.90 per day, 76% live in rural areas, and 73% are employed in agriculture. Through OBUL’s loans, mindset change programs, financial literacy training, and business management skills, we address the multifaceted needs of our clients living in extreme poverty.

Women:

A disproportionate number of those living in extreme poverty are women and girls, whose economic challenges are compounded by gender-based discrimination and exclusion at home, in schools, and in the workplace. Opportunity Bank has reached 11,821 women of the 27,576 loan clients and 200,118 women of the 379, 326 savers.

Impact – Highlights from the 2024 Client Satisfaction Survey by 60 Decibels

Savers:

87% of savers reported an improved quality of life due to OBUL’s services. They shared testimonials like:

- “With savings in the bank, I have been able to pay school fees for my two children without struggling, relieving me of the burden and stress.”

- “When I lost my job, my savings helped me start a business and also pay school fees for my children.”

- “They have helped me manage my savings effectively. I can withdraw anytime and feel confident it is safe, unlike when I used to keep it at home.”

Loan Clients:

- 40% of clients report a significant increase in income due to OBUL.

- 36% of clients say employment has increased, with more than two-thirds of those clients employing others.

- 86% of clients say financial worries have decreased.

Client testimonials include:

- “After buying farm supplies, my yields increased, enabling me to earn more and pay tuition for my children.”

- “I can take my children to school, added a room and electricity to the house, and my business is doing well.”

- “I bought more pigs and expanded the farm. Now, the pigs are generating income, allowing me to afford things like clothes, food, and medical expenses.”

Measuring Impact:

Creating a lasting positive impact in the lives of the most vulnerable requires more than just good intentions. At Opportunity Bank, we ensure we use best practices to improve services, reach more families in poverty, and deliver better social outcomes. We measure and assess the impact of our services and training to stay focused on reaching those most in need with tools to help transform their lives. Our efforts include:

- Analysing client data to understand who we are reaching and how their lives are improving.

- Simplifying product pricing and making it more transparent.

- Promoting social reporting within the organization, helping the bank attract funding and expand services by focusing on client needs and outcomes.

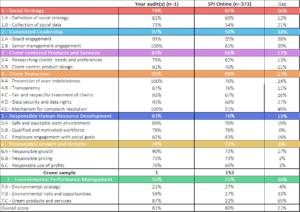

Opportunity Bank has embraced Social Performance Management (SPM) as a tool to measure impact. SPM ensures that we understand our clients’ needs and equips us to design products and services that enable clients to transform their futures and communities.

OBUL SPM Global Benchmark by Dimension – March 2024 Results

Mainstreaming financial Inclusion for Persons with disabilities in Uganda

Opportunity Bank Uganda Limited is committed to the transformation of people’s lives, including persons with disabilities (PWDs). We provide a full range of financial services, including VSLA loans and savings facilities, as well as training.

Outreach Target Clients by Categorization:

- PWDs: 61%

- Caregivers: 28%

- Well-wishers: 11%

Our Partners:

- Opportunity International UK

- Community Fund

- Association of Microfinance Institutions of Uganda (AMFIU)

- National Union for Persons with Disabilities in Uganda (NUDIPU)

- Cheshire Services Uganda (CSU)

- PWD District Unions: Iganga, Soroti, Mayuge, Luuka, Mbale, Lira, Oyam, Omoro

- National Union of Women with Disabilities in Uganda (NUWODU)

What We Do:

- Ensure accessibility to financial services.

- Involve PWDs in planning and building.

- Develop networks and linkages.

- Build institutional capacity.

- Collect disability data and build a business case.

- Conduct community sensitization to break down barriers.

- Provide training and capacity-building programs.

Products and Services:

- VSLA account with a minimum balance of 10,000 UGX.

- Individual savings accounts with a minimum balance of 5,000 UGX.

- Loans at competitive interest rates, with unsecured loans up to 20,000,000 UGX.

- Training in mindset change, financial literacy, and business management.

- VSLA digitization.

Impact:

- Over 30,000 PWDs and their caregivers have accessed formal financial services and training in financial literacy and business management.

- 91% of PWDs feel they are valued contributors to their families and communities.

- 52.6% of PWDs did not have access to formal financial services before joining OBUL.

- 15% of households report increased income.

- 21.9% of PWD households earn between 50,000 UGX and above.

- Over 200 staff members have been trained to enhance their attitudes towards PWDs.

- 5% of OBUL staff are PWDs.

- Disability inclusion is integrated into the bank’s daily operations and strategic plan.

Client Testimony:

Hajira lost three of her children and her husband within a short span of time. Devastated by grief, she struggled with sleepless nights. After her child’s passing, she was left caring for a grandchild with a disability. Encouraged by her friends, she joined a savings group. However, she initially lacked financial literacy, and after a year of saving, she spent it on a family celebration. After receiving training from OBUL, she learned the importance of saving, borrowing, and withdrawing wisely. She invested in five chickens, which she sold to buy a goat. She later sold the goat and set up a stall to sell tomatoes. Following OBUL’s advice, she opened a personal savings account, where her savings earned interest. She reinvested her earnings and completed the house her children had started building. She now supports four children with their school fees, lives a fulfilling life, and has gained confidence in public speaking. She is now the women’s councillor at Local Council One and continues to seek more training from OBUL.